A couple of you have queried the excise charges as detailed in the Budget Economic and Fiscal Update 2024 (BEFU) which is the guts behind the budget announcements. Robert Brewer, Spirits NZ, has kindly provided the following link and information.

https://www.treasury.govt.nz/sites/default/files/2024-05/befu24.pdf

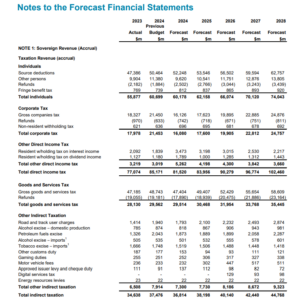

Look for the 2024 Forecast and 2025 Forecast columns and scroll down to near the bottom under Other Indirect Taxation you will see two references to alcohol excise – one for domestic and one for imports (handily separated by a couple of lines. The straight maths on these numbers would have us believe that excise will increase by about 6% – which is a nasty number.

This is not actually what the excise equivalent duty will go up by however. It is likely it will remain at an increase of 4.1% as signalled by Customs. The 6% increase is the government assuming that people will drink more and, therefore, more excise will be gained as a result. We know this is not the case and, in fact, you can see this isn’t the case from the table if you compare the 2024 Previous Budget column with the 2024 Budget Forecast column. There’s about $90 million drop between budgeted and forecast. This is a point made repeatedly with Customs and Treasury but they ignore this for the purposes of their budget cycle.

Importantly, and in support of the earlier comment about 4.1% being the increase that will be applied is that the out years are all increasing by about 4%. And lastly if you really want to see how all this is applies then take a look at the 2023 BEFU (https://www.treasury.govt.nz/sites/default/files/2023-05/befu23.pdf) where they forecast an 11% increase in domestic alcohol excise and 6% for imports.